Information Technology Pathways to Effective Mergers

By Brice Ominski, Global CTO of DeepDive World

“Many companies have become good at dealing, but integration planning is where value is preserved or eroded.“1 – Scott Whittaker.

Executive Summary

“Companies spend over $2 trillion on acquisitions yearly, yet the M&A failure rate is between 70% and 90%. Executives can dramatically increase their odds of success…if they understand how to select targets …and how to integrate them.”2

The role of information technology (IT) in mergers and acquisitions is crucial to successful integration, yet it is often underestimated. IT is critical in ensuring smooth integration, a stage where many mergers encounter significant challenges. Effective IT management is essential to determine whether a merger achieves its objectives or falls short.

DeepDive World’s merger approach emphasizes a thorough understanding of merger goals to manage IT delivery adeptly and ensure the architecture supports the Merger’s expected outcomes. This approach, coupled with a proven track record, delivers value and instills confidence throughout the process.

In this article, we cover:

- Types of Mergers help us better understand the different mergers and the unique IT opportunities each type of merger presents. It is the starting point for understanding the outcomes of that Merger.

- The Technology Stack model and its layers offer crucial insights into the architectural elements that require management. By comprehensively understanding these technology components, we can identify and effectively manage the architectural deliverables necessary for successful integration.

- Actionable advice includes practical strategies to adopt an outcome-driven approach that ensures successful merger results.

While this article does not delve into the entirety of DeepDive World’s merger approach, it outlines key considerations in setting expectations for merger outcomes that we discuss with our clients. By starting with a solid grasp of required IT management, DeepDive World ensures that the Merger’s rollout architecture delivers value and aligns with and fulfills the set objectives and expectations.

Types of Mergers and Expected Technology Outcomes

Different types of mergers offer varying opportunities for value delivery, setting the overall expectations for the IT outcomes that must be delivered to achieve these outcomes.3

Here, we look at the top four merger situations and how understanding the role of IT will benefit each one.

- The Conglomerate. This approach looks to integrate two dissimilar companies. While these companies do not share many commonalities in terms of IT across all levels of the technology stack, the conglomerate can leverage infrastructure and business directory service.

- Same Industry Type. Integrating industries of the same type often provides significant business opportunities by increasing the scale of offerings without revising the target business model to achieve significant strategic benefits. However, caution is required. For example, where a unionized organization acquires a non-union company. Many opportunities to build a shared integration were obfuscated behind the business rules across these organizations with very different business models. This approach looks to integrate two dissimilar companies. However, these companies share few commonalities in terms of IT across all levels of the technology stack.

- Related Industries—New Target Business Model. One key opportunity in a merger is integrating capabilities from both source companies to create a new business model in the target company, capitalizing on synergistic effects. It is crucial to drive the target architecture at all levels to align with the new objectives. This approach also enables the organization to leverage cutting-edge technology to modify its operating model agilely.

- The Digital Merger. Digital acquisitions often have unique issues.4 That situation requires careful integration at every level of the technology stack, as it often involves merging industries with innovative business models. While these acquisitions enhance agility, they come with inherent technological debt. For example, the widespread adoption of microservices must evolve into more advanced integration methods that minimize manual coding.

The Technology Stack

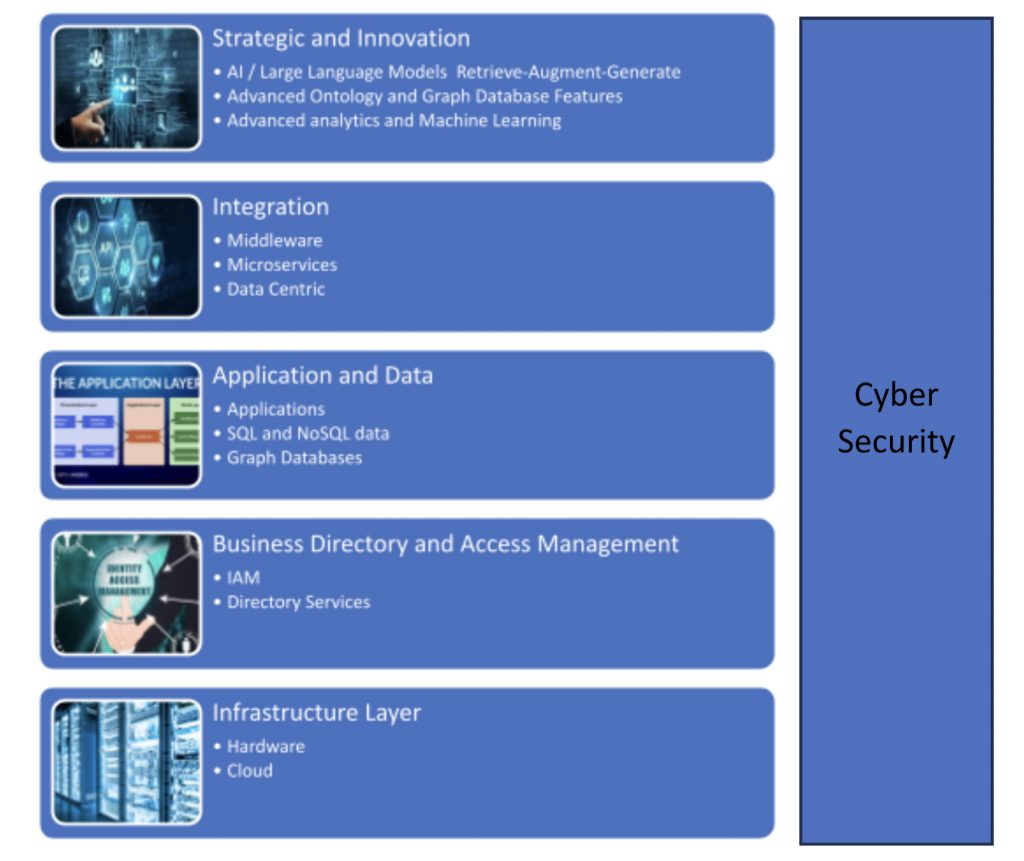

The technology stack offers a framework for understanding how various technologies interrelate and support one another, from foundational infrastructure to advanced strategic innovations:

- The Infrastructure Layer is essential for enabling higher-level capabilities, such as cloud services and on-premises hardware, which can be optimized to achieve cost efficiencies and enhance operational performance.

- Business Directory and Access Management Layers ensure seamless access to technologies and data and facilitate effective integration and standardization across merged entities. Identity access management and directory services provide the glue that connects the enterprise and the end users.

- Application and Data Layers: The consolidation of data systems and applications eliminates operational silos and improves accessibility, which in turn enhances efficiency. For example, adopting enterprise-wide licensing agreements through consolidating application platforms also reduces licensing costs.

- The Integration Layer deploys effective integration strategies, such as employing middleware or adopting microservices, to improve the connectivity between disparate applications and data systems. This layer enhances operational efficiency through seamless data exchange and reduces the reliance on hard-coded integration details. Advanced integration platforms like MuleSoft or Dell Boomi facilitate robust, real-time communication between systems, improving flexibility in business models and enabling more dynamic responses to market changes.

- Strategic Layer: Technologies like AI and large language models, which reside at this layer, offer transformative potentials that can redefine business models and drive significant value if the underlying technology stack is robust.

Figure 1 The Technology Stack

This table presents the value that can typically be achieved at each layer.

| Technology Stack Layer | Savings Opportunities | Strategic Opportunities |

| Infrastructure Layer | Consolidate hardware (servers, storage, etc.) to leverage economies of scale and reduce operational and licensing costs. | Leverage the cloud for distribution across multiple jurisdictions. |

| Business Directory | Implement a unified IAM system consolidating user access across both companies’ resources, reducing administrative overhead and license cost reductions. | Tightly integrating directory services and IAM solutions ensures consistent access control policies and user management processes, improving the overall user experience.

Position IAM as a facilitator for new business initiatives, such as mergers and acquisitions, by ensuring quick and secure integration of new systems and user base. |

| Application and Data Layer | Integrating applications and data systems eliminates silos, improving data accessibility and operational efficiency. Utilizing enterprise-wide licensing agreements for integration platforms reduces license costs. | The adoption of data-centric approaches dramatically improves business agility. Implementing advanced data analytics and visualization tools enables better decision-making and innovation, driving business growth and competitive advantage by reducing the number of disparate applications.

Using graph databases for knowledge representation streamlines data access and enables more effective exploration of complex relationships within the data. |

| Integration | Integrating applications and data systems eliminates silos, improving data accessibility and operational efficiency. Utilizing enterprise-wide licensing agreements for integration platforms reduces license costs. | Robust integration platforms (e.g., MuleSoft, Dell Boomi) and seamless communication between disparate systems facilitate real-time data exchange. Additionally, centralized monitoring and management tools enhance visibility and control, improving operational efficiency. This approach improves integration flexibility and delivers more flexible business models. |

| Strategic Layer | AI applications streamline processes and automate repetitive tasks, reducing manual effort and operational costs. | AI assists in strategic decision-making by analyzing vast amounts of data and simulating various scenarios to inform long-term planning and investment strategies. Leverage Retrieve Augment Generate patterns with LLMs and graph databases for exceptional pattern recognition. Consider leveraging advanced analytics and machine learning. |

Figure 2 Streamline and Efficiency Vs Strategic Value

Merger IT Value by Type

In this section, we revisit each merger type but focus on the value they can deliver. Those situations where the merger target involves revising the business model offer the most excellent opportunity and significant risk.5 They are listed from least to most value delivery (or from least to most complexity).

- Conglomerate Mergers: These mergers involve entities with few commonalities, and IT can help bridge diverse systems to achieve economies of scale. Here, the infrastructure and business Directory layers provide the most incredible opportunity to deliver cost savings through consolidation. Since the targeted Merger does not involve consolidating the business model across the two organizations, there is also little opportunity to achieve higher value on the technology stack unless the joint business model is revisited (see Related Industries and New Business Models).

- Same Industry Mergers: IT can consolidate and enhance similar technologies and processes to scale operations effectively without overhauling the existing business models. Although there are significant opportunities to consolidate infrastructure and Business Directory layers, there may also be opportunities to consolidate applications and data, including enhanced integration within the target company and its ecosystem. The two merging organizations’ business models must adopt a single outcome.

- Related Industries with New Business Models: These mergers present the most significant opportunities and challenges, requiring a complete rethinking of IT architecture to support innovative business models. Here, the new business model is the heart of the target architecture and allows re-implementation of each technology layer. Of course, the more abstract the technology layer, the more opportunity to leverage a new business model and create value.

- Digital Mergers: These focus on integrating digital technologies across the board, necessitating a sophisticated approach to managing inherent technological debts and leveraging advanced integrative technologies like microservices. They are challenging but rewarding mergers that must be managed across all technology stack layers. Digital mergers are much more complex than they might appear because the digital company may have difficulty growing beyond the current level of digital asset investment.

Architecting Outcomes and Organizational Change

DeepDive World ensures that all architectural elements are traceably managed, aligning with the expected outcomes and mitigating risks.6 The merger strategy is meticulously crafted around steps and architectural adjustments that directly link to the anticipated results for that specific merger type, enhancing success and reducing risk. Changes in the business model represent significant forward-looking targets. Even in digital companies, technology debt poses a substantial challenge. Consequently, we often advocate for a phased, long-term deployment plan over a big-bang approach.

DeepDive World always recommends the creation of a Merger Implementation Office with close ties to the architecture team. Changes in people, processes, and technology need to be carefully managed, and often, organizational change management assistance is required to roll out properly across the organization, as its culture will also potentially change.

Conclusions

The DeepDive team brings extensive experience executing various mergers, impacting every level of the technology stack. With our advanced technology and proven techniques, we ensure that our phased approach to merger integration not only mitigates risks but also meets and often exceeds expectations. Engaging with DeepDive World can help streamline your merger process, ensuring a smooth and successful integration. Don’t hesitate to contact me or one of the senior members of the DeepDive World team to discuss how to manage your merger project to a successful outcome.

1 Whitaker, Scott C. Mergers & Acquisitions Integration Handbook: Helping Companies Realize the Full Value of Acquisitions (Wiley Finance Book 657) (p. 41). Wiley, 2012. Kindle Edition.

2 Clayton M. Christension, Richard Alton, Curtis Rising and Andrew Waldeck. The Big Idea: The New M&A Playbook, (Harvard Business Review), 2011.

3 Graham Kenny, Don’t Make This Common M&A Mistake (Harvard Business Review), March 16, 2020

4 Arnaud Leroi, 3 Ways M&A Is Different When You’re Acquiring a Digital Company (Harvard Business Review), July 11, 2017.

5 That risk needs to be explicitly managed through the architecture and its role in setting up key deliverables and managing to the merger project.

6 The greater the number of technology stack elements affected and consolidated, the more critical it becomes to manage architectural outcomes effectively to ensure success. Each element impacted represents a crucial piece of technology that is required for the successful outcome.